Portugal has become an increasingly popular destination for individuals seeking to relocate from the UK. Its pleasant climate, beautiful scenery, and affordable cost of living make it an attractive choice for many expatriates. Moreover, Portugal offers a favourable tax regime known as the Non-Habitual Resident (NHR) regime, which can provide significant tax benefits for those who qualify. In this article, we will explore the details of Portugal’s NHR tax regime, its benefits, and the requirements for obtaining non-habitual resident status.

What is Portugal’s NHR tax regime?

The Non-Habitual Resident (NHR) regime is a special tax regime introduced by the Portuguese government in 2009 to attract foreign professionals and high-net-worth individuals to become tax residents in Portugal. Under this regime, individuals who qualify as non-habitual residents can benefit from a flat income tax rate of 20% for certain types of income and enjoy tax exemptions on foreign source income.

Why become a non-habitual tax resident in Portugal?

The main advantage of becoming a non-habitual tax resident in Portugal is the significant tax benefits it offers. Foreign source income, such as pensions, dividends, royalties, and capital gains, derived from eligible activities can be tax-exempt in Portugal for a period of ten years. This can result in substantial tax savings, particularly for individuals with significant income from abroad.

Portugal NHR and double taxation agreements

Portugal has an extensive network of double taxation agreements with many countries, including the UK. These agreements aim to prevent individuals from being taxed on the same income in both Portugal and their home country. Under the NHR regime, individuals can take advantage of these double taxation agreements to ensure that their income is taxed only in one jurisdiction, further reducing their overall tax liability.

Who can apply for non-habitual resident status in Portugal?

To qualify for non-habitual resident status in Portugal, certain criteria must be met. Firstly, individuals must not have been tax residents in Portugal in the previous five years. Secondly, they must become tax residents in Portugal by establishing a habitual residence or spending more than 183 days in Portugal during a tax year. Finally, applicants must engage in eligible professional activities or obtain income from eligible sources to benefit from the NHR regime’s tax advantages.

NHR and the Portugal Golden Visa program

It is worth noting that the Non-Habitual Resident regime is separate from the Portugal Golden Visa programme, which offers residency and citizenship to individuals who make certain qualifying investments in the country. While the two programmes are distinct, individuals who obtain residency through the Golden Visa programme can also apply for non-habitual resident status and enjoy the tax benefits associated with it.

Tax residency requirements for the Portuguese non-habitual resident regime

To establish tax residency in Portugal under the NHR regime, individuals must either establish a habitual residence or spend more than 183 days in Portugal during a tax year. Establishing a habitual residence involves having a place to live in Portugal with the intention to remain there for an indefinite period. This can be proven by various factors, including property ownership or long-term rental agreements.

Do I have to buy or rent property to prove residency in Portugal?

While buying or renting property in Portugal can be one way to establish a habitual residence, it is not the only requirement. Other factors, such as family ties, economic interests, and social integration, are also considered when determining tax residency. It is important to consult with a tax professional to understand the specific requirements and options available to prove residency in Portugal under the NHR regime.

Tax Under the Non-Habitual Resident Regime in Portugal

Once non-habitual resident status is obtained in Portugal, individuals can benefit from favourable tax treatment. Foreign source income derived from eligible professions or eligible sources is generally exempt from tax in Portugal for a period of ten years. This includes income from pensions, dividends, royalties, and capital gains. Portuguese source income, on the other hand, is generally subject to a flat income tax rate of 20%.

Which professions are considered to be of high value under the NHR tax regime?

Under the NHR regime, certain professions are considered to be of high value and qualify for the tax benefits. These professions include engineers, architects, doctors, dentists, nurses, teachers, researchers, IT professionals, artists, and athletes. However, this list is not exhaustive, and other professions that contribute to the scientific, technological, or cultural fields may also be eligible.

Tax treatment of foreign source income under the NHR regime

Foreign source income derived from eligible professions or eligible sources is generally exempt from tax in Portugal for a period of ten years. This means that if you qualify as a non-habitual resident and earn income from pensions, investments, or other eligible sources outside Portugal, you can enjoy tax savings by not being subject to Portuguese income tax on that income.

Tax treatment of Portuguese source income under NHR status

While foreign source income enjoys tax exemptions, Portuguese source income is generally subject to a flat income tax rate of 20% for non-habitual residents. This includes income from employment, self-employment, rental properties, and other sources within Portugal. The advantage of the NHR regime is that it provides a predictable and favourable tax rate for Portuguese source income, ensuring transparency and simplicity in tax matters.

Timeline and Important Dates for NHR application

The timeline for the NHR application process can vary depending on individual circumstances. It is advisable to begin the process well in advance of your intended move to Portugal to ensure a smooth transition. Important dates to keep in mind include tax year-end deadlines and the need to register as a tax resident with the Portuguese tax authorities.

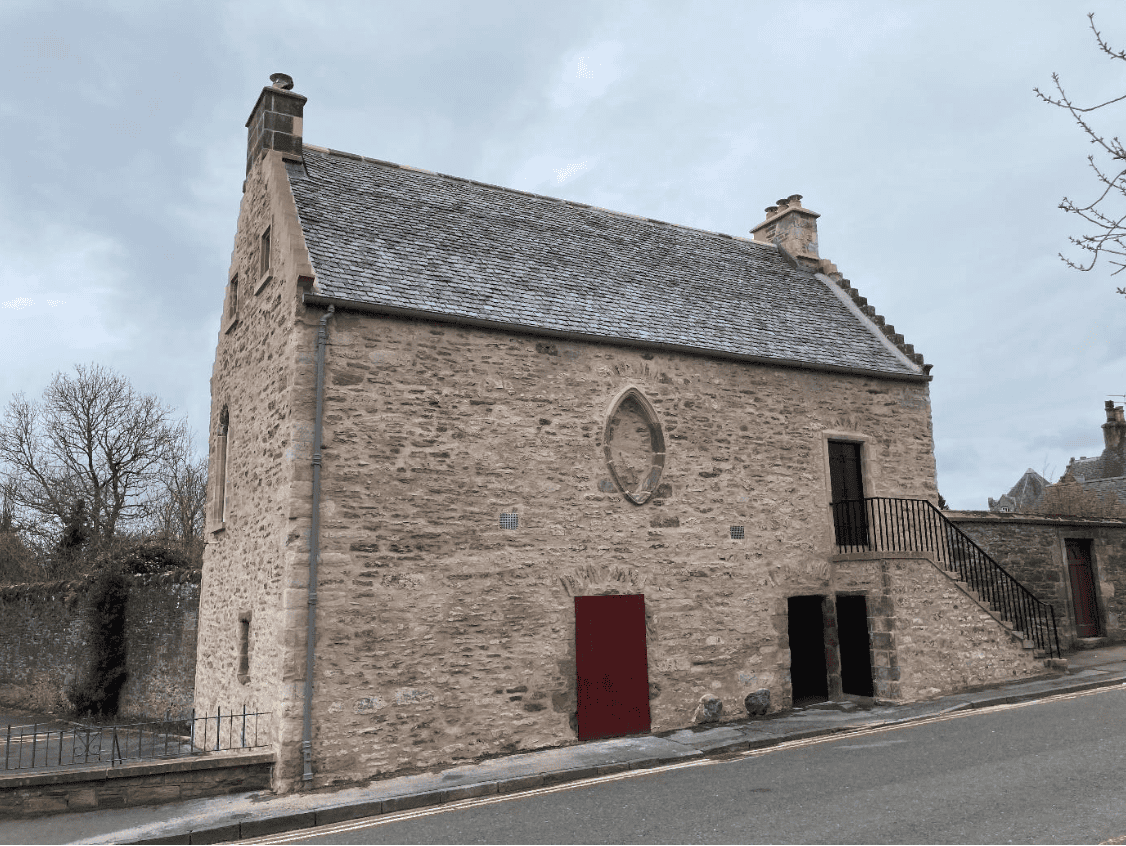

Why choose Doree Bonner for your move to Portugal

When planning your move to Portugal, it is essential to choose a reliable and experienced moving company. Doree Bonner has a wealth of expertise in international relocations and can assist you in every step of the moving process. From packing and shipping to storage, customs clearance and delivery, Doree Bonner ensures a seamless and stress-free relocation experience.

Currency exchange can also be a crucial aspect of your move to Portugal, particularly if you need to transfer funds from the UK to Portugal or convert currency for property purchases or other financial transactions. Our preferred partner, Smart Currency Exchange, specialises in international currency transfers and provides competitive exchange rates, low fees, and personalised service to ensure that your money is transferred efficiently and securely.

Moving to Portugal and becoming a non-habitual tax resident under the NHR regime can offer significant tax advantages for individuals from the UK. With a favourable tax regime, double taxation agreements, and a wide range of benefits for eligible professions and sources of income, Portugal provides an attractive destination for those seeking to optimize their tax situation. By understanding the requirements, seeking professional advice, and partnering with reputable service providers like Doree Bonner International and Smart Currency Exchange, you can ensure a smooth and successful transition to your new life in Portugal. Get a free online quote for your move from the UK to Portugal or contact us for advice and assistance.